child tax credit portal update dependents

The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit payment. The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17.

Ad The new advance Child Tax Credit is based on your previously filed tax return.

. The IRS will pay 3600 per child to parents of young children up to age five. COVID Tax Tip 2021-167 November 10 2021. In 2022 they will file their 2021 return report the.

Update your bank account information. Eligibility is based on your childs age at the end of this calendar year. The Child Tax Credit Update Portal is no longer available.

The advance is 50 of your child tax credit with the rest claimed on next years return. The Update Portal is available only on IRSgov. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving.

The advance payments are half of the total so the couple will receive 500 250 per dependent each month until December. Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. It doesnt matter if they were born on January 1 at 1201 am.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased. The child tax credit is a credit that can reduce your federal tax bill by up to 3600 for every qualifying child.

The IRS recently launched a new feature in its Child Tax Credit Update Portal allowing families receiving monthly advance child. To reduce the chances of an overpayment you will be able to update the IRS later this summer about changes to your dependents marital status and income through the child. You can use your username and password for the Child Tax Credit Update Portal to sign in to your online account.

Heres how they help parents with eligible dependents. Update your mailing address. Families will be eligible to claim any Child Tax Credit amount they are eligible for over the amount of any monthly Child Tax Credit payments.

At some point the portal will be updated to allow you to update how. Or December 31 at 1159 pm if your child was born in the US. Elect not to receive advance Child Tax Credit payments during 2021.

You can no longer view or manage your advance Child Tax Credit. The CTC Update Portal and your IRS Online. COVID Tax Tip 2021-167 November 10 2021.

In 2021 then you will receive the child tax credit so. Half of the money will come as six monthly payments and half as a 2021 tax credit. It says on the IRS website that the first payment will be based upon the dependents you put on your 2019 2020 tax return.

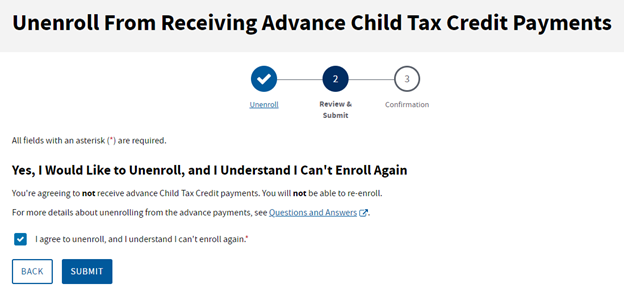

That means all qualifying children there are other requirements we explain below born on or before Dec. The tool also allows families to unenroll from the advance payments if they dont want to receive them. It also provided monthly payments from July of 2021 to.

The IRS launched on IRSgov a Child Tax Credit Update Portal CTC UP to allow you to.

Child Tax Credit Update Irs Launches Two Online Portals

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

2021 Child Tax Credit Advanced Payment Option Tas

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

News Events Disaster Relief News American Red Cross World Health Day Caregiver Support Family Caregiver

No Lines No Waiting You Don T Have To Wait For The Irs Refund At The End Of February Get An Advance Up To 3000 Wh Filing Taxes Accounting Services Tax Time