are funeral expenses tax deductible in california

As an individual youre not able to deduct funeral expenses on your tax return per the IRS. So a 25 souvenir death DVD would no longer cost 25 but 2706.

Federal Fiduciary Income Tax Workshop

While the IRS allows deductions for medical expenses funeral costs are not included.

. Thankfully some of these expenses may be tax-deductible. There is no tax deduction for funeral costs due to the fact that the IRS allows medical expenses. No never can funeral expenses be claimed on taxes as a deduction.

Individual taxpayers cannot deduct funeral expenses on their tax return. A couple of funeral expenses are not eligible for tax deductions. Unfortunately funeral expenses are not tax-deductible for individual.

Unfortunately funeral costs and car loans are not deductible. It has been recommended. No never can funeral expenses be claimed on taxes as a deduction.

Unfortunately funeral expenses are not tax-deductible for individual taxpayers. The ability to deduct funeral expenses on your tax returns depends on who paid for the funeral expenses. Were trying to consider things about a.

Can You Deduct Funeral Expenses On A 1041. There are expenses from the funeral that are deductible from the estate. These deductible expenses include accounting.

The IRS views these as the personal expenses of the family members and other people in attendance and therefore doesnt allow them as deductions. The IRS allows deductions for medical expenses to prevent or treat a medical illness or condition but not. While funeral costs paid by friends family or even paid from the deceased individuals account are not deductible from your annual taxes.

The state gets to collect sales tax on such personal property. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. Funeral expenses are not tax-deductible.

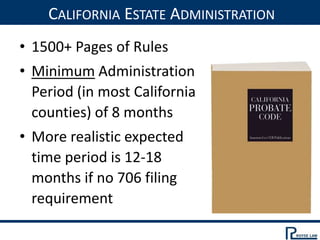

Can I deduct funeral expenses probate fees or fees to administer the estate. Expenses that exceed 75 of your federal AGI. Individual taxpayers cannot deduct funeral expenses on their tax returns.

Individual taxpayers cannot deduct funeral expenses on their tax return. These are personal expenses and cannot be deducted. In other words if you die and your heirs pay for the funeral.

The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases. This may include the costs of hiring a funeral director embalming and preparation fees. What expenses are deductible on estate tax return.

You also cant claim funeral expenses as a medical expense for the deceased either. The IRS deducts qualified medical expenses. Funeral expenses that are NOT tax-deductible are any which are not paid by the deceased persons estate.

Funeral Costs Paid by the Estate Are Tax Deductible. These costs include cremation burial plot casket embalming transportation eg. While the IRS allows deductions for medical expenses funeral costs are not included.

If you dont know who regulates the cemetery youre interested in ask the cemetery manager If you need help with a cemetery or funeral issue visit the Bureaus Web site at wwwcfbcagov. Other expenses such as medical can also be deducted from your taxes. These are considered to be personal expenses of the family members and attendees and funeral expenses are not deductible on personal income tax returns.

This means that you cannot deduct the cost of a funeral from your individual tax returns. The taxes are not deductible as an individual only as an estate. In order for funeral expenses to be deductible you would need to have paid for the funeral expenses from the estates funds that you are in charge of settling.

In short these expenses are not eligible to be claimed on a 1040 tax. Deductible medical expenses may include but are not limited to the following. Any travel expenses incurred by family members of the deceased are not deductible.

This blog post will discuss what funeral expenses are tax-deductible and how you can claim them on your tax. Funeral expenses are not tax deductible because they are not qualified. No you are not able to claim deductions for funeral expenses on Form 1041.

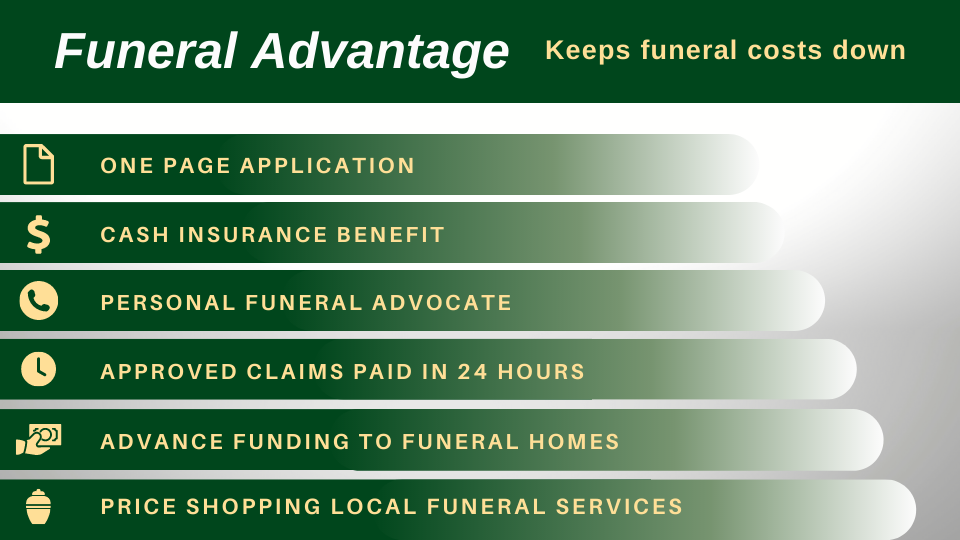

California Funeral Burial Insurance Costs Faqs Lincoln Heritage

The Wonderful Tax Benefits Of Owning Your California Home Derek Sneed Oso Realty Group

Ca 2022 2023 Budget Ends Nol Deductions Business Credits Suspensions

Free Health Insurance California Quotes Smart Insurance Agents

California Collection Braille Institute Of America

California Hunts For Income Tax From Out Of State Sellers

Tax Deductions For Funeral Expenses Turbotax Tax Tips Videos

California Decedent Estate Practice Legal Resources Ceb Ceb

Pin On Editable Online Form Templates

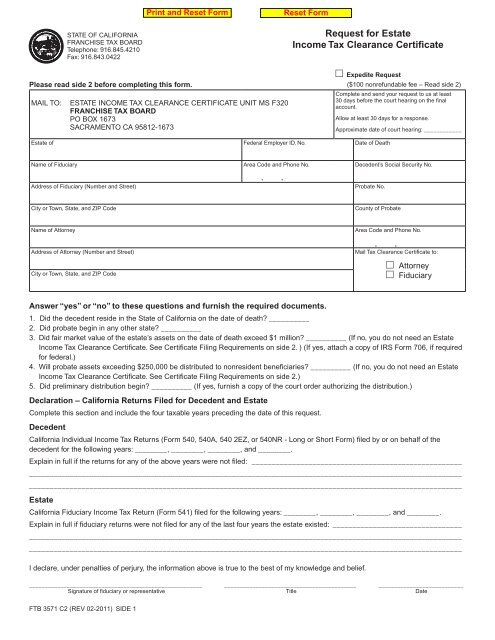

Ftb 3571 Request For Estate Income Tax Clearance Certificate